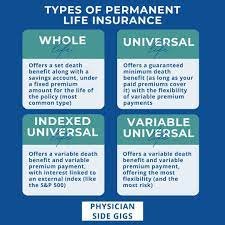

Are you looking for the best Variable universal life insurance policies ? It is a type of life policy designed to offer flexibility and investment opportunities. They combine features of whole life insurance and variable whole life policies, allowing the policyowner to adjust premiums and death benefits. These policies also include a cash value component, which grows based on the performance of chosen investments. This feature provides both security and potential growth, making it a unique choice among whole life policies.

Variable Universal Life Insurance Policies

Variable universal life insurance policies offer a balance between protection and investment. Policyowners can customize their coverage by adjusting the premium and death benefit as their needs change. Unlike traditional whole life policies, these policies allow for investments in variable accounts, offering a chance for higher returns. However, the cash value in these policies depends on the market, which adds a level of risk to the security typically found in life and variable life products.

What Are Variable Universal Life Insurance Policies?

Variable universal life insurance are a blend of whole life insurance and investment options. They provide a death benefit while building cash value through investments chosen by the policyowner. These policies stand out because they offer flexibility in premiums and the ability to grow cash value with market-based returns. While they offer potential rewards, policyowners must consider the risks involved in variable investments compared to the stable security of traditional whole life insurance.

Benefits of Variable Universal Life Insurance Policies

Variable Universal Life Insurance Policies offer flexibility in premium payment and allow the policyowner to adjust the face amount or coverage. These policies combine life insurance with investment options, where the cash value account can grow based on interest rates or market performance. Despite the investment risk, many policies guarantee a guaranteed minimum death benefit, providing the insured with financial security. Reviewing the prospectus is essential to understand all associated risks and rewards.

Variable Life Insurance Options

Universal life insurance policies options provide the policyowner with a blend of life coverage and investment opportunities. Unlike adjustable life policies, these allow the cash value to grow depending on the performance of selected investment accounts. While the policies guarantee a guaranteed minimum level of protection, they also involve higher investment risk. Understanding the following statements about each option is crucial to decide which suits your needs.

Variable Life Insurance vs. Variable Universal Life Insurance

The main difference between variable life insurance and variable universal life insurance policies lies in flexibility and guarantees. Variable universal life policies allow flexible premium payments and adjustments to coverage, whereas standard variable life insurance have fixed premiums. Both types include investment opportunities but require careful consideration of the cash value account performance and correct regarding their investment risk. Always analyze the policy’s features to ensure it aligns with your financial goals.

Key Features of Variable Life Insurance Products

It provide flexibility and security for policyowners. These products include a separate account for variable investments, allowing individuals to manage funds according to their preferences. Life policies have a guaranteed minimum death benefit, ensuring protection for loved ones. Gerald wants a life insurance that offers both growth potential and insurance protection. Variable products flashcards can help understand these features better.

In-Depth Insights into Chapter 4

Chapter 4 delves into the benefits of a universal life policy with option 2, which allows policyowners to establish variable investments and maximize cash value growth. Policies have a guaranteed minimum death benefit, designed to meet diverse needs by offering options for both stability and investment growth. Quizlet and memorize flashcards containing terms like a variable life insurance license make it easier to grasp the details of these policies.

Chapter 4: Variable Life Insurance Policies Explained

It combine investment opportunities with life insurance protection. They require policyowners to maintain products with a guaranteed death benefit while exploring potential growth through a series of variable investments. Memorize flashcards containing terms like a universal life policy with option 2 to deepen your understanding of these policies. Quizlet is an excellent tool to study and master the complexities of variable insurance products.

Core Concepts Highlighted in Chapter 4

The Investment Company Act of 1940 requires insurers to maintain a separate account for variable policies. This separate account ties the policy cash value and investment performance together, which means the cash value is not guaranteed. The policy offers flexibility, allowing the policyowner to buy term life coverage or adjust the amount of premium. However, because the policy is considered a security, a Series 6 license is required to sell it. This type of policy provides death protection but comes with investment risk as it does not guarantee a return.

Variable Life Insurance Overview

A variable universal life insurance policies combines insurance and securities, giving the policyowner the ability to invest in separate premium accounts. The policy face amount can increase with investment performance, while the death benefit increases over the policy period if certain conditions are met. However, this policy’s value is not guaranteed since it is tied to the separate account, making it subject to market fluctuations. The NAIC ensures these policies meet regulatory standards, while the company act of 1940 requires a cap for sales fees to protect premium policyowners.

Popular Variable Life Insurance Products

Variable premium life contracts are popular for their universal component, which allows flexibility in premium payments and investment choices. Flashcards containing terms like “variable” highlight key features such as the death benefit, which can increase with account performance, and the investment activity in the separate account. These premium policies do not guarantee an assignment provision, and the cash value is not guaranteed due to market risks. Policyowners can choose the investment vehicle that best meets her needs, but the investment accounts require careful management to balance investment risk and potential growth.

How to Choose the Right Variable Life Insurance Product

When choosing a universal life insurance policies , it’s important to understand that it does not guarantee a return on investment. The policy describes the investments and establishes a cap for sales, ensuring insurers maintain a separate account for investment accounts. The investment risk is tied to the market, and while it offers flexibility in making premium payments, it does not guarantee an assignment or fixed outcomes. Products bound by NAIC regulations often define the universal component that refers to the ability to adjust premiums over time.

Variable life insurance provides flexibility and allows the policyowner to make variable investments at the time of policy application. However, this type of policy often includes market products with terms like a variable insurance contract. The amount of insurance and level premiums may fluctuate based on market performance, making it essential for buyers to weigh their investment accounts carefully. Always consider the term policy structure and evaluate if the insurers maintain a separate account to support your financial goals effectively.