A speeding ticket show up on insurance records sooner than most people expect. The impact of speeding tickets on car insurance premiums varies depending on factors like the state you live in, your auto insurance company, a speeding ticket show up on insurance speeding ticket canshow up on insurance, the effects of speeding tickets on car insurance premiums, and how to reduce the financial burden of a violation.

What is a Speeding Ticket’s Impact on Insurance?

A speeding ticket is more than just a fine—it signals to your auto insurance company that you’re a higher risk. This can lead to an insurance rate increase, which may last for several years. But how quickly does a speeding ticket show up on insurance?

When a speeding ticket show up on insurance, it depends on the reporting process. Some insurance companies find out about the ticket during your policy renewal, while others may notice it as soon as the DMV updates your motor vehicle record.

How Much Does a Speeding Ticket Raise Insurance?

Severity and Impact on Rates

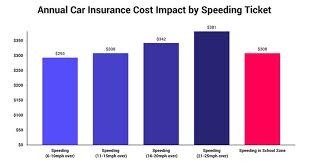

A single speeding ticket might raise your insurance rates by 20% to 30%, depending on the severity of the violation. For instance, going 15 mph over the limit typically leads to a smaller increase compared to being convicted of reckless driving or excessive speeding.

Impact of Multiple Tickets

If you have two or more speeding tickets, the increase becomes more substantial. Some insurers may even cancel your car insurance policy due to a history of tickets, making it harder to find affordable car insurance.

How Quickly Does a Speeding Ticket Affect Insurance?

When does a speeding ticket show up on insurance records? Here’s a breakdown:

Immediate Updates

-

- Some states update the DMV’s system within days of issuing a ticket.

- This allows insurance providers to access the information quickly.

Policy Renewal Period

- Many insurance companies typically review your record during your policy renewal. If your motor vehicle record shows a recent ticket, your premium may increase.

Variable Timing by Insurers

- Each auto insurance company has its own review process. Some delay adjustments until they have verified the violation, while others act immediately.

How Long Does a Speeding Ticket Stay on Your Record?

A speeding ticket will likely remain on your driving record for three to five years, depending on your state’s laws. For example:

- In California, most speeding tickets affect your record for three years.

- In Texas, severe violations can stay on your record for five years or more.

During this time, the impact of speeding tickets on your car insurance rates can be significant.

Driving record

When you receive a speeding ticket, it can impact your car insurance significantly. Car insurance companies use your driving record to determine your auto insurance rates, and a speeding ticket can cause an increase in your insurance. The severity of the speeding violation will determine how much the increase in your insurance will be. Even a Speeding Ticket Show Up on Insurance could increase your car insurance rates for several years, affecting the insurance costs during that time.

Clean driving record

In most cases, speeding tickets stay on your driving record for three years, but the effect on your vehicle insurance may vary. Insurance providers may check your driving record at renewal, causing your auto insurance rates to reflect the impact on your car insurance due to a speeding ticket. If the violation is severe, it may cause a more substantial increase in your insurance coverage, but this may not always be the case with a minor speeding ticket. You can potentially keep your insurance costs low by maintaining a clean driving record and avoiding a Speeding Ticket Show Up on Insurance.

Do All Tickets Affect Car Insurance?

Not all traffic tickets lead to an increase in insurance rates. Minor infractions, such as parking tickets, usually don’t affect your premiums. However, serious violations, like DUI or reckless driving, result in higher insurance rates and may stay on your record for longer.

How State Laws Influence Insurance Rates

Some states regulate how a Speeding Ticket Show Up on Insurance. records:

- States That Forbid Increases

- A few states forbid insurance companies from considering minor speeding violations when calculating premiums. For example, California restricts rate increases for single minor violations.

- States That Allow Adjustments

- States like Texas or Florida permit insurers to raise premiums for even one minor speeding ticket, leading to higher insurance rates.

How to Minimize Insurance Rate Increases

Take a Defensive Driving Course

Many insurance companies offer discounts if you complete a state-approved defensive driving course. This can offset the insurance rate increase caused by a ticket.

Shop for Car Insurance Quotes

After receiving a ticket, it’s wise to compare car insurance quotes online. Switching to a licensed insurance carrier that offers competitive rates can help you save money.

Increase Your Deductible

Opting for a higher deductible can lower your premiums, though you’ll need to pay more out-of-pocket in the event of a claim.

Steps to Remove a Speeding Ticket from Your Record

In some states, you can get a speeding ticket dismissed or removed from your record by:

- Completing a driving course.

- Contesting the ticket in court.

- Paying a fee to have it expunged.

Removing the ticket off your record can prevent a rise in your premiums and restore your clean motor vehicle record.

Why Insurance Companies Increase Rates

Insurance providers calculate premiums based on risk. A speeding ticket shows up on insurance records as a sign of risky behavior, leading to increased premiums. The insurance industry views such violations as predictive of future claims.

Save on car insurance

If you want to save on car insurance, it’s important to compare auto insurance quotes from different providers to find the best car insurance rate. Many car insurance companies offer discounts for safe driving and bundling policies, helping you offset the increase in your car insurance premiums after a speeding ticket. Additionally, you may find that certain insurance products cater to drivers with a speeding ticket on their record, allowing you to keep your insurance costs manageable despite the violation.

Comparing Car Insurance After a Speeding Ticket

Get New Quotes

After receiving a ticket, search for auto insurance quotes from different providers. Some insurers specialize in offering cheap insurance options for high-risk drivers.

Reputable Insurance Carriers

Stick to reputable insurance carriers when switching policies. While saving money is important, ensure your new provider meets your insurance needs with reliable coverage.

Does the Type of Coverage Matter?

The type of coverage you have—minimum liability or full coverage—affects how much a ticket will increase your premiums. Coverage car insurance policies with comprehensive or collision coverage may see smaller increases compared to minimum-coverage plans.

Frustrating to pay for car insurance

While it may be frustrating to pay for car insurance with the added costs from a speeding ticket, there are ways to minimize the impact. For example, taking a defensive driving course might allow you to ticket off your driving record in some states. Some insurers may even reduce your rates after a certain time has passed, especially if you’re a safe driver with no further violations. To get insurance at the best car insurance rates, it’s essential to compare auto insurance policies and choose one that aligns with your needs and budget.

FAQs of a Speeding Ticket Show Up on Insurance.

How long does it take for a speeding ticket to show up on insurance?

It varies by state and insurer, but most tickets are reported within days or during your next policy renewal.

Can I prevent a speeding ticket from raising my insurance?

Taking a defensive driving course or contesting the ticket in court can help. Some insurers also offer forgiveness for a first speeding ticket.

How can I find affordable car insurance after a ticket?

Compare car insurance quotes online, increase your deductible, or bundle policies (e.g., with homeowners or renters insurance).

Will a speeding ticket always raise my premiums?

Not always. Some states and insurers don’t penalize minor speeding violations, while others do.

How can I lower my insurance premiums after a ticket?

Maintain a clean driving record, shop for insurance online, and consider adjusting your coverage.