How much does it cost to visit a dermatologist with insurance? Visiting a dermatologist is essential for maintaining skin health. Whether addressing acne, hair loss, or skin cancer prevention, understanding costs helps you plan effectively. Health insurance can significantly reduce your out-of-pocket expenses for dermatology care.

What Is a Dermatologist Visit?

A dermatologist visit involves professional care for skin health and treatment of skin conditions. It’s important to know how much a dermatologist visit with insurance will cost to plan accordingly and avoid unexpected expenses.

Overview of Dermatology Visits

A dermatology visit typically involves diagnosing and treating skin conditions, examining moles or lesions, and discussing skincare routines. Some visits may focus on cosmetic treatments like Botox or fillers.

Common Reasons for a Dermatology Appointment

People seek dermatologic care for issues such as severe acne, eczema, or psoriasis. Preventative screenings for skin cancer or addressing hair loss are also frequent reasons. The cost of a dermatologist visit with insurance is often reduced for medical reasons, like skin cancer screenings.

Why Early Visits Matter

Delaying dermatology visits can lead to worsening conditions. Early diagnosis and treatment of skin problems prevent long-term complications.

Cost of a Dermatologist Visit with Insurance

The cost of seeing a dermatologist with insurance depends on your health insurance coverage and the type of health insurance plan you have. Typically, insurance covers a portion of the cost of dermatology services.

Average Cost

The average cost of a dermatology visit with insurance ranges from $20 to $75 for copays, depending on your plan and provider.

Factors That Affect the Cost

- Type of Insurance Plan: Costs vary based on coverage details.

- Deductibles: Meeting your deductible affects the total out-of-pocket cost.

- Procedures Required: Specialized treatments, like those for severe cystic acne, may increase costs.

Cost Breakdown

Additional tests or biopsies performed during visits can add to the total cost. Always confirm with your insurance provider to understand coverage for a dermatologist visit with insurance.

How Health Insurance Helps Reduce Costs

Health insurance can reduce the cost of seeing a dermatologist by covering a portion of the treatment. This helps make dermatological care more affordable for patients in need of quality care.

Covered by Insurance

Most health insurance plans cover dermatologic care for medical conditions. Services such as mole checks, skin cancer screenings, and treating inflammatory acne are typically covered by insurance during a dermatologist visit with insurance.

Insurance Plans and Copays

Insurance plans often require a copay for dermatologist visits. The amount depends on whether the visit is categorized as preventative care or involves dermatology procedures.

Benefits of Comprehensive Coverage

Comprehensive health plans may include preventive measures and routine check-ups, minimizing unexpected expenses for patients.

Dermatologist Visits Without Insurance

Without health insurance, a dermatologist visit may cost more out of pocket. Understanding the cost of seeing a dermatologist without insurance can help you decide whether to seek an in-person visit.

Cost Without Insurance

If you see a dermatologist without insurance, costs may range from $150 to $300 for an initial consultation, depending on location and services.

Payment Plans and Options

Some dermatology clinics offer payment plans or discounts for uninsured patients. Flexible options can make treatments more accessible.

How to Find Affordable Care

Search for clinics offering sliding scale fees or community health centers for reduced dermatologic care costs.

Types of Dermatology Treatments

Dermatology treatments can range from skin care advice to advanced procedures. The cost of dermatology treatments varies, and insurance may cover different types of treatments depending on your provider.

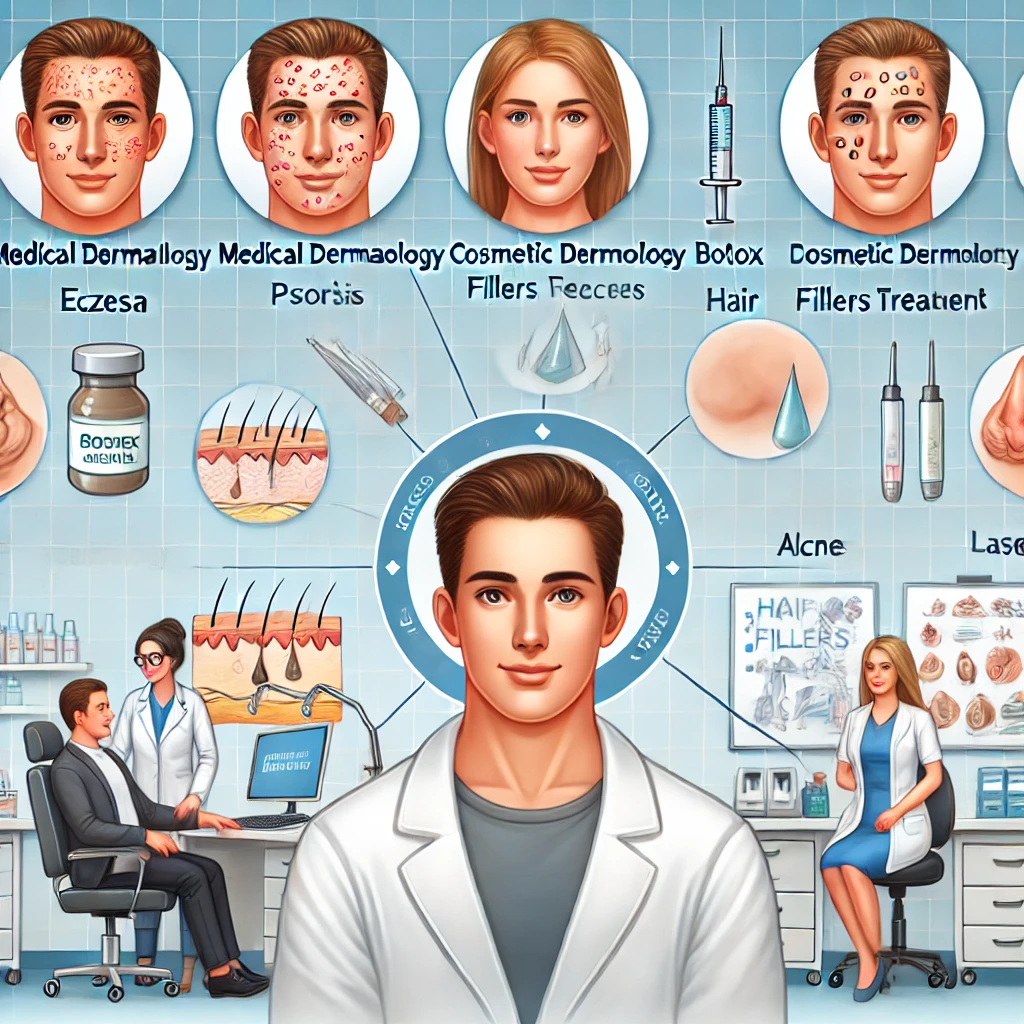

Medical Dermatology

This includes treating conditions like eczema, psoriasis, and moderate acne. A dermatologist can provide long-term care for chronic conditions.

Cosmetic Dermatology

Cosmetic treatments such as fillers, Botox, or laser procedures address aesthetic concerns.

Specialized Dermatology

This includes hair loss treatments and care for severe cystic acne. Such treatments often cost more, even with insurance.

Pediatric Dermatology

Specialists in pediatric dermatology address skin conditions unique to children, such as birthmarks or eczema.

Tips for Choosing a Dermatologist

Choosing a dermatologist is crucial to receive the care you need for your skin health. Make sure to find a dermatologist who accepts your insurance provider and offers the care you need for a dermatologist visit with insurance.

Check Your Insurance

Ensure your insurance provider covers dermatology services and verify which dermatologists are in-network for a dermatologist visit with insurance.

Look for Expertise

Choose a dermatologist who specializes in your specific skin condition.

Read Reviews

Online reviews can provide insight into patient experiences and the quality of care.

Ask About Services

Not all dermatologists offer the same range of services. Confirm availability for treatments you may need.

Scheduling Your Dermatology Appointment

To schedule an appointment with a dermatologist, it’s important to check your insurance coverage. Understanding how much is covered by your insurance can make scheduling your appointment for a dermatologist visit with insurance more straightforward.

Referral from Primary Care Physician

Some insurance plans require a referral from your primary care doctor to visit a dermatologist.

Initial Consultation

During the first dermatologist visit, you’ll discuss your medical history and any specific concerns about your skin health.

Follow-Up Visits

Regular follow-ups are crucial for ongoing conditions like acne or eczema. Discuss a treatment plan during your initial consultation.

Insurance Coverage for Dermatology

Insurance coverage for dermatology can reduce the cost of seeing a dermatologist, depending on your provider and insurance company. The amount covered by a health plan may vary based on the type of health insurance you have. Be sure to understand your coverage for a dermatologist visit with insurance.

What Insurance Typically Covers

Insurance policies often cover treatments for skin disorders, preventive screenings, and certain dermatology procedures.

What Is Not Covered

Cosmetic procedures like Botox or chemical peels are usually not covered by health insurance.

Importance of Knowing Your Policy

Understanding your specific insurance terms can prevent surprises when billing arrives after your dermatologist visit with insurance.

Factors That Influence Dermatology Costs

- Location: The cost of living in your area affects dermatology prices.

- Clinic Type: Larger dermatology clinics may charge more for services.

- Time of Visit: Peak times may have higher consultation fees.

- Severity of Condition: More complex cases require advanced treatments, increasing costs.

- Experience of the Dermatologist: Specialists with extensive experience may charge higher fees.

Preventive Care in Dermatology

Preventive care in dermatology helps detect issues early and is often covered by health insurance. Knowing how much a dermatologist visits with insurance covers can ensure you get the proper patient care during your dermatology appointment.

Routine Screenings

Regular skin cancer screenings and mole checks can save lives. These are often covered by insurance.

Skincare Guidance

Dermatologists provide valuable advice on maintaining healthy skin, including product recommendations and lifestyle tips.

Diet and Lifestyle Impact

Your diet and daily habits significantly affect your skin’s health. Discuss these with your dermatologist during visits.

Final Thought

The cost to see a dermatologist with insurance depends on your healthcare provider and how much is covered based on your health insurance plan. The American Academy of Dermatology recommends timely visits to a dermatology office, as a dermatologist may help address concerns early in the field of dermatology. Be sure to understand the coverage for your dermatologist visit with insurance to get the care you need.

FAQs

How much does a dermatologist visit cost with insurance?

The cost typically ranges between $20 and $75 for copays, depending on your insurance plan and the services received.

Is acne treatment covered by insurance?

Yes, most insurance plans cover medical treatments for moderate to severe acne.

Do I need a referral to see a dermatologist?

This depends on your insurance policy. Some plans require a referral from a primary care physician.

What is the cost of cosmetic dermatology treatments?

Cosmetic procedures are not covered by insurance and can range from $200 to $1,500, depending on the service.

Are skin cancer screenings covered by insurance?

Yes, preventive skin cancer screenings are typically covered by most insurance providers.

Can I visit a dermatologist without insurance?

Yes, but the cost may be higher. Some clinics offer affordable payment options for uninsured patients.

How do deductibles affect dermatology costs?

Until you meet your deductible, you may have to pay more out of pocket for dermatology services.

What are the best insurance plans for dermatology?

Look for comprehensive health plans that include dermatologic care as part of preventive and medical coverage.

What should I bring to my first dermatologist visit?

Bring your medical history, a list of current medications, and any specific concerns about your skin.