Disability can strike unexpectedly, and it can seriously affect your ability to perform the duties of your regular occupation. That’s where own occupation disability insurance comes into play. This type of disability insurance ensures that if you’re unable to perform the substantial and material duties of your specific occupation, you can still receive a disability benefit. It’s designed to cover those who find themselves unable to perform their occupation due to illness or injury.

In this article, we will explain the ins and outs of own occupation disability insurance. We’ll explore how it protects your income, why it’s an essential disability insurance policy, and how it differs from other types of coverage. Whether you’re in a medical specialty or another high-skill field, this type of coverage could be crucial for your financial security. Let’s dive deeper into the details.

What Is Own Occupation Disability Insurance?

Own occupation disability insurance is a policy that provides disability income if you are unable to work in your specific occupation due to illness, injury, or a medical condition. Unlike other disability insurance policies, it doesn’t require you to be unable to perform any work, just the duties of your regular occupation. This means that even if you can work in another job, as long as you can’t perform the material and substantial duties of your regular occupation, you can still receive benefits.

The coverage offered by own-occupation insurance policies is valuable for professionals like doctors, lawyers, and other specialists who have spent years developing expertise in a specific field. If an injury or illness makes them unable to work in their own occupation, they can still receive a monthly benefit to replace their lost income.

Key Features of Own Occupation Disability

- Material and Substantial Duties: The term material and substantial duties refers to the key responsibilities and tasks that make up your job. If you can no longer perform these duties, you qualify for own occupation disability insurance benefits.

- Income Protection: This insurance is designed to provide you with a monthly benefit that replaces a portion of your lost income while you’re unable to work in your own occupation.

- Flexibility: Own-occupation policies often allow you to work in a different role without losing your disability benefits. This flexibility can help those unable to work in their primary career but still capable of doing other types of work.

- Coverage for Various Occupations: Whether you are a medical specialty professional, a corporate executive, or any other occupation, this type of insurance can provide a safety net for your unique skills.

How Does Own Occupation Disability Insurance Work?

The first step in own occupation disability insurance is determining the definition of disability outlined in your policy. True own-occupation insurance policies specify that you are disabled if you are unable to perform the substantial and material duties of your occupation, even if you could work in another field.

This is different from any occupation policies, which may require you to be unable to perform duties in any job, not just your own occupation. By providing occupation coverage, own occupation disability insurance gives you the peace of mind knowing that if you can’t work in your own occupation, you will still receive benefits to help you maintain your lifestyle.

Benefits of Own Occupation Disability Insurance

Monthly Benefits: If you are unable to perform the duties of your specific occupation, you will receive a monthly benefit from your own occupation disability insurance policy. The amount you receive depends on your policy’s terms and the percentage of income covered.

Tax-Free Benefits: In many cases, if you pay for own occupation disability insurance with after-tax dollars, the benefits you receive are tax-free, making them a valuable source of income during a disability.

Income Replacement: For high-income earners, such as those in medical specialties, own occupation disability insurance can replace a significant portion of lost income, making it a crucial part of a financial plan.

Job Flexibility: Own occupation disability insurance allows you to work in a different job or another occupation without losing your benefits, which isn’t always the case with any occupation policies.

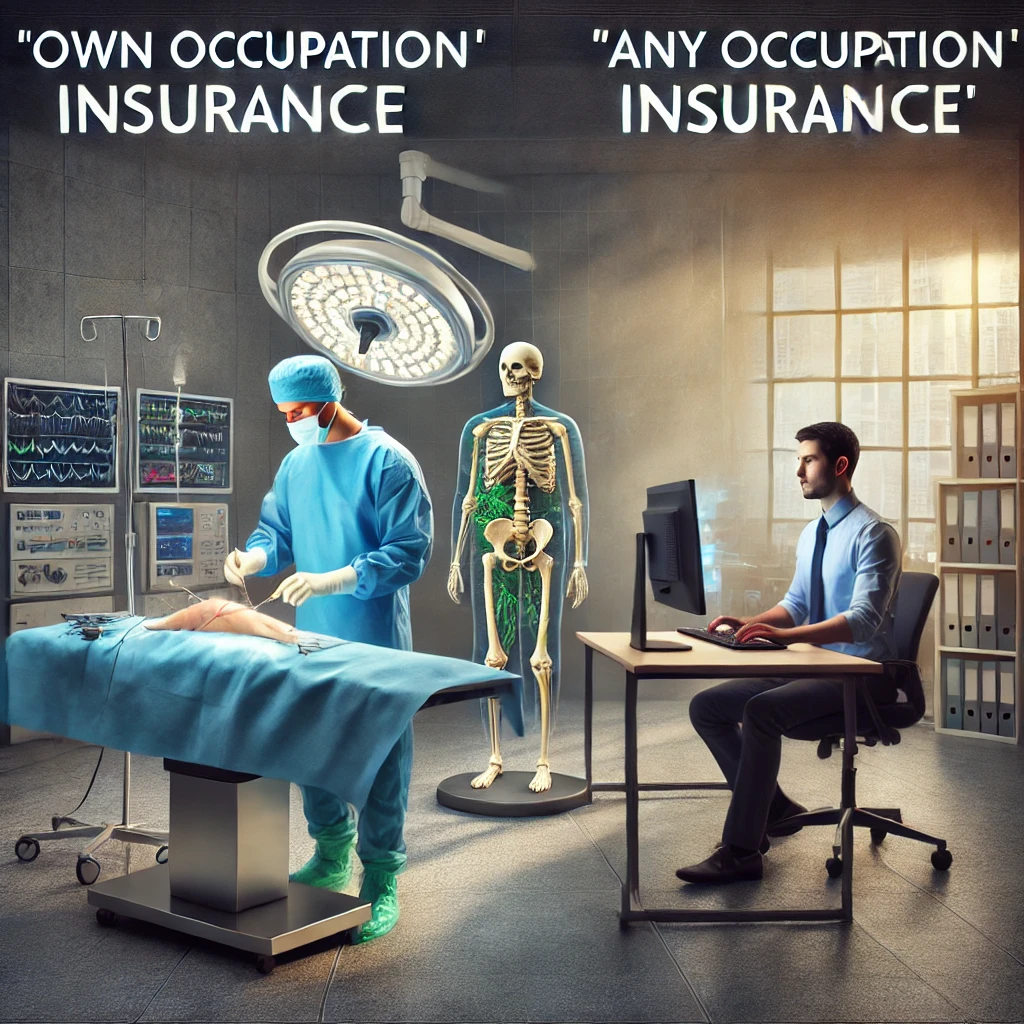

The Difference Between Own Occupation and Any Occupation Insurance

When choosing a disability insurance policy, it’s important to understand the difference between own occupation and any occupation definitions.

- Own Occupation: If you can’t perform the duties of your occupation, you qualify for benefits, regardless of whether you can work in a different job. This is the most comprehensive form of disability coverage for those who rely heavily on their specialized skills.

- Any Occupation: If you are unable to perform the duties of any occupation, not just your own, you may qualify for benefits. This is a more restrictive form of insurance that requires you to be totally disabled to the point of not being able to work in any field.

Why Own Occupation Disability Insurance Matters

For professionals in medical specialties or other high-skill fields, own occupation disability insurance can be a game-changer. Imagine you are a surgeon, and an injury prevents you from performing surgeries. With own occupation disability insurance, you would still be able to receive benefits even if you’re able to work in a different capacity, such as teaching or consulting. However, without this type of coverage, you might find yourself without benefits if you can still perform any other job.

Many insurance companies offer disability insurance policies, but not all offer own occupation coverage. It’s important to carefully read the fine print of disability policies to ensure they meet your needs. Own-occupation disability insurance policies tend to be more expensive because they offer broader protection, but the additional cost can be worth it for those whose careers rely on specific skills.

Real-Life Example: A Surgeon’s Need for Own Occupation Disability Insurance

Consider a surgeon who suffers a severe hand injury. Despite the injury, the surgeon might still be able to perform some form of work, such as teaching or working in a research role. However, due to the injury, they cannot perform surgeries, which is their own occupation.

Without own-occupation disability insurance, the surgeon might not be eligible for benefits, even though they are no longer able to perform the duties of their regular occupation. But with own occupation disability insurance, the surgeon can still receive disability payments to replace their lost income, allowing them to maintain their financial stability while they transition to a new type of work.

How to Qualify for Own Occupation Disability Insurance

To qualify for own occupation disability insurance, you must meet the definition of total disability set out by the policy. Generally, you must be unable to perform the material and substantial duties of your regular occupation due to illness or injury.

Steps to Get Own Occupation Disability Insurance

- Assess Your Needs: Consider how much income you would need to replace if you became disabled and unable to perform your regular occupation.

- Get a Quote: Reach out to insurance companies for quotes on own-occupation disability insurance policies. They will assess factors such as your occupation, age, health, and income to provide you with a customized quote.

- Review the Policy: Carefully review the definition of disability in the policy. Make sure it aligns with your needs, especially the coverage for being unable to perform the duties of your own occupation.

- Purchase the Policy: Once you find the right policy, purchase it to protect yourself and your income in case of an unexpected disability.

- Stay Informed: It’s important to periodically review your disability insurance policies to ensure that your coverage continues to meet your needs, especially if your career or health changes.

Final Thought:

Own occupation disability insurance provides essential protection for those who rely on their specialized skills. If you are unable to work in your specific occupation due to an illness or injury, this type of insurance will ensure you receive a disability benefit. Unlike other types of coverage, own occupation disability insurance allows you to continue working in a different job without losing your benefits, making it an ideal choice for professionals in fields that require specialized knowledge, such as doctors and lawyers.

Whether you’re looking for long-term disability coverage, a rider on a disability insurance policy, or a true own occupation policy, it’s crucial to understand how these options work. By investing in own-occupation disability insurance, you’re protecting not only your income but your ability to maintain your standard of living in the event of a disabling condition.

FAQS:

What is Own Occupation Disability Insurance?

Own occupation disability insurance provides disability income insurance if you become unable to perform the substantial duties of your occupation due to illness or injury. It pays benefits if you cannot perform your own occupation, even if you can work in any occupation.

How Does Own Occupation Differ from Any Occupation Insurance?

Own occupation policies pay benefits if you cannot work in your own occupation, while any occupation policies require you to become unable to perform duties in any occupation. Own occupation offers more targeted occupation disability coverage.

Can I Work in Another Job and Receive Benefits?

Yes, with own occupation disability insurance, you can work in any occupation and still receive full benefits as long as you cannot perform the duties of your own occupation. This depends on your individual policy terms.

How Do I Qualify for Total Disability?

To qualify for total disability, the policy may define total disability as being unable to perform the substantial duties of your occupation. If you meet this, you can receive benefits during your time of disability.

What Happens if I Cannot Perform My Job Duties?

If you become unable to perform your own occupation, you can file a disability claim. Disability insurance is designed to provide income insurance if you cannot work due to a disability.