When you’re ready to compare and buy the best insurance plans, knowing how to navigate this process can save you both time and money. Start by exploring a leading insurance platform that offers a comprehensive range of options for travel, car, bike, and health plans from the top insurance providers in Pakistan. This convenience allows you to tailor your search to meet your specific needs. Look for plans with pre-negotiated rates that provide competitive prices, ensuring you can find the best price on the market.

Next, focus on the types of coverage you need, whether it’s personal, family, or specific plans like hospitalization coverage or critical illness coverage. Don’t forget to consider add-on covers for your life insurance or options like home insurance and solar insurance. As you evaluate these plans, think about saving for the future through options like a retirement plan or an investment plan. Use these tips during your search: start with step 01 to identify your needs, move to step 02 to compare options, and finalize with step 03 to buy the policy that offers the best coverage for you. Always remember, with the right guidance, you can find great savings that you won’t easily find elsewhere.

Understanding Different Types of Insurance

Health Insurance:

Health insurance is essential for covering medical expenses. When looking for the best insurance plan, you can choose from various options tailored to your needs.

Personal Health Insurance:

This plan focuses on individual coverage, providing you with essential medical services and treatments.

Family Health Insurance:

Family health insurance covers multiple members under one policy, making it a convenient and often more affordable option.

Hospitalization Coverage:

This coverage ensures that you are financially protected during hospital stays and surgical procedures, which is vital for any comprehensive health plan.

Critical Illness Coverage:

Critical illness coverage offers financial support if you are diagnosed with a serious condition, ensuring you can focus on recovery without financial strain.

Car Insurance:

Car insurance is necessary for vehicle owners to protect against accidents, theft, and damage. Selecting the best insurance plan can provide peace of mind while driving.

Travel Insurance:

Travel insurance covers unexpected events while you’re away from home, including medical emergencies, trip cancellations, and lost luggage. A solid travel insurance policy is part of the best insurance plan for frequent travelers.

Life Insurance:

Life insurance secures your family’s financial future in the event of your passing. It’s a crucial component of a comprehensive financial plan.

Saving & Protection:

These policies combine insurance coverage with savings, allowing you to build wealth while ensuring financial security.

Retirement Plan:

A retirement plan through life insurance can provide income during retirement, making it a valuable addition to your financial strategy.

Marriage Plan:

This type of plan helps you save for significant life events, like marriage, ensuring you can afford the expenses when the time comes.

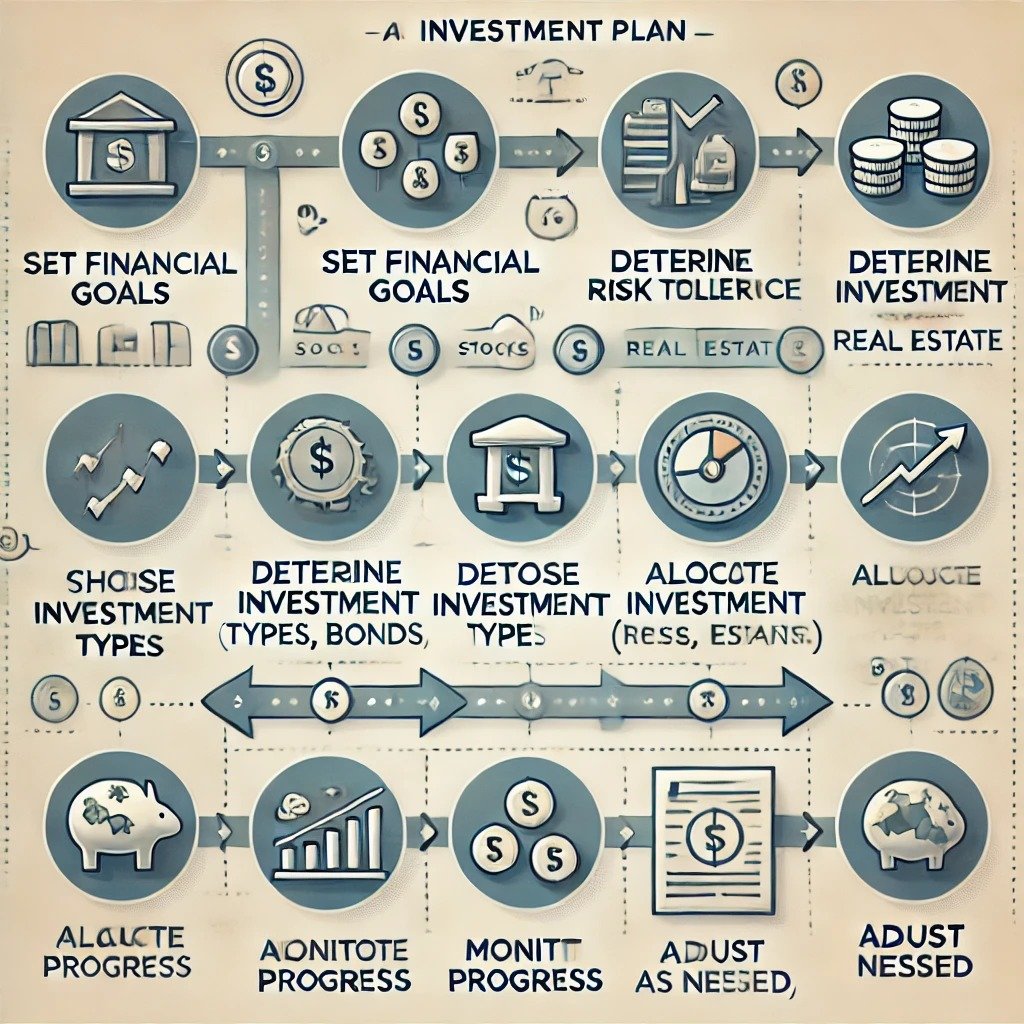

Investment Plan:

Investment plans linked with life insurance can yield returns while providing coverage, making them an attractive option for many.

Home Insurance:

Home insurance protects your property from damage and theft, covering the cost of repairs and replacement. Finding the best insurance plan for homeowners is essential for safeguarding your investment.

Solar Insurance:

Solar insurance covers installations of solar panels, protecting you from potential damages and ensuring your investment is secure.

Employee Benefits:

Employee benefits often include insurance options, making it easier for you to access health and life insurance through your employer, which can be a cost-effective way to find the best insurance plan.

How to Compare and Buy Insurance Plans

Finding the best insurance plan requires a systematic approach. Follow these steps to ensure you make the right choice.

Step 01:

Identify your coverage needs. Understanding what types of insurance you need will help narrow your options.

Step 02:

Gather quotes from various providers. Comparing these quotes will help you find the best insurance plan that fits your budget and needs.

Step 03:

Review the details of each policy. Look for exclusions and coverage limitations to ensure you choose the most comprehensive option available.

Tips for Getting the Best Coverage

Assess your needs:

Understand what coverage you truly require.

Compare multiple quotes:

Don’t settle for the first offer you receive.

Read reviews:

Check customer feedback to find reliable providers.

Seek professional advice:

Consulting with an insurance expert can provide valuable insights.

Bottom lines

Take control of your coverage by understanding your needs. Assess your requirements for health, life, car, and home insurance to make informed decisions. Always gather multiple quotes and compare policies side by side. This helps you identify the best insurance plan that offers comprehensive coverage at competitive rates. Don’t hesitate to seek professional advice when navigating the insurance landscape. Experts can provide insights that lead you to the best insurance plan tailored to your situation. Be aware of any exclusions, coverage limitations, and the claims process to avoid surprises later. A thorough understanding of your policy ensures you choose the best insurance plan for your needs. Insurance is a crucial aspect of financial security. Take proactive steps today to secure the best insurance plan for yourself and your loved ones, ensuring peace of mind for the future.

Frequently Asked Questions

Why do I need Life insurance?

Life insurance is crucial for ensuring your loved ones are financially secure in the event of your untimely passing. It’s an integral part of a best insurance plan.

What are the Benefits and Add-On Covers of Life Insurance?

Life insurance can offer various benefits, including coverage for critical illnesses and additional policies for added protection, enhancing the overall value of your best insurance plan.

How can I Buy Life Insurance?

You can buy life insurance through agents, online platforms, or directly from insurers. Always compare policies to ensure you choose the best insurance plan.

What is the Life Insurance Claims Process?

The life insurance claims process involves notifying the insurer, submitting required documents, and waiting for approval. Understanding this process can help you make an informed choice when selecting the best insurance plan.

What is Coverage Limitations in Life Insurance?

Every life insurance policy has certain limitations, such as exclusions for specific causes of death or waiting periods. Be sure to read the policy thoroughly to understand these limitations and how they may impact your coverage.